Modern finance executives face a critical decision in today’s data-driven business environment: settle for tools that enable manual processes or invest in solutions that empower strategic FP&A transformation. While traditional FP&A tools with Excel front-ends and basic dashboards may seem sufficient, they’re fundamentally enablement solutions that still require extensive manual work.

In contrast, Corporate Performance Management (CPM) software, when implemented by proven partners with deep finance and technical expertise, delivers true empowerment through automated, integrated solutions.

Business Intelligence (BI) tools like Power BI and Tableau are great at visualizing data, but fall short when it comes to system integration and planning. These solutions do not provide direct integrations to automate reporting that reconciles with your general ledger, nor do they provide driver-based, collaborative forecasting and planning amongst finance and business unit leaders.

BI tools typically require:

These BI and rudimentary FP&A tools fall into what we call the “enablement trap.” They enable you to do your existing work slightly faster, but they don’t fundamentally transform how finance operates within your organization. You still experience the following three issues:

1. Reactive rather than proactive – waiting for data to be ready rather than having real-time insights

2. Isolated from operations – working with financial data in silos rather than integrated business intelligence

3. Focused on reporting – spending time on what happened rather than planning for what can happen

Corporate Performance Management software represents a paradigm shift from enablement to empowerment. When implemented by experienced partners who understand both finance processes and technical architecture, CPM solutions transform finance teams from number-crunchers into strategic business partners.

CPM software connects directly to your source systems – ERP, CRM, HR systems, and operational databases – creating a unified data architecture to plan and model from. This isn’t just about having dashboards; it’s about having trusted, real-time data that updates automatically without manual intervention.

Consider the difference: an FP&A tool might help you build a better version of your monthly variance report, but a CPM solution automatically pulls actual results from your ERP, compares them to your integrated budget and forecast, and identifies meaningful variances as they occur.

The gap between CPM software potential and actual results often comes down to implementation quality. Proven implementation partners like FutureView Systems bring several critical capabilities:

1. Proven Finance Process Knowledge

Understanding not just how to configure software, but how finance teams actually operate. This includes knowledge of:

2. Technical Solution Architecture Expertise

Building solutions that scale and integrate seamlessly with your existing technology stack. This means:

3. Change Management Understanding

Transforming how finance teams operate requires more than just software deployment. Experienced partners help with:

Organizations that successfully implement CPM software with experienced partners typically experience the following when working with FutureView Systems:

1. Reduced budget cycles to 3 weeks, from 2-3 months

2. Complete automation of routine financial, management, and board reporting

3. Real-time visibility into performance metrics

4. Consistent reporting across all business units and geographies

5. Finance teams spending 80% of time on analysis rather than data preparation

6. Faster identification of business opportunities and risks

7. Enhanced ability to model and evaluate strategic initiatives

8. Improved collaboration between finance and operations teams

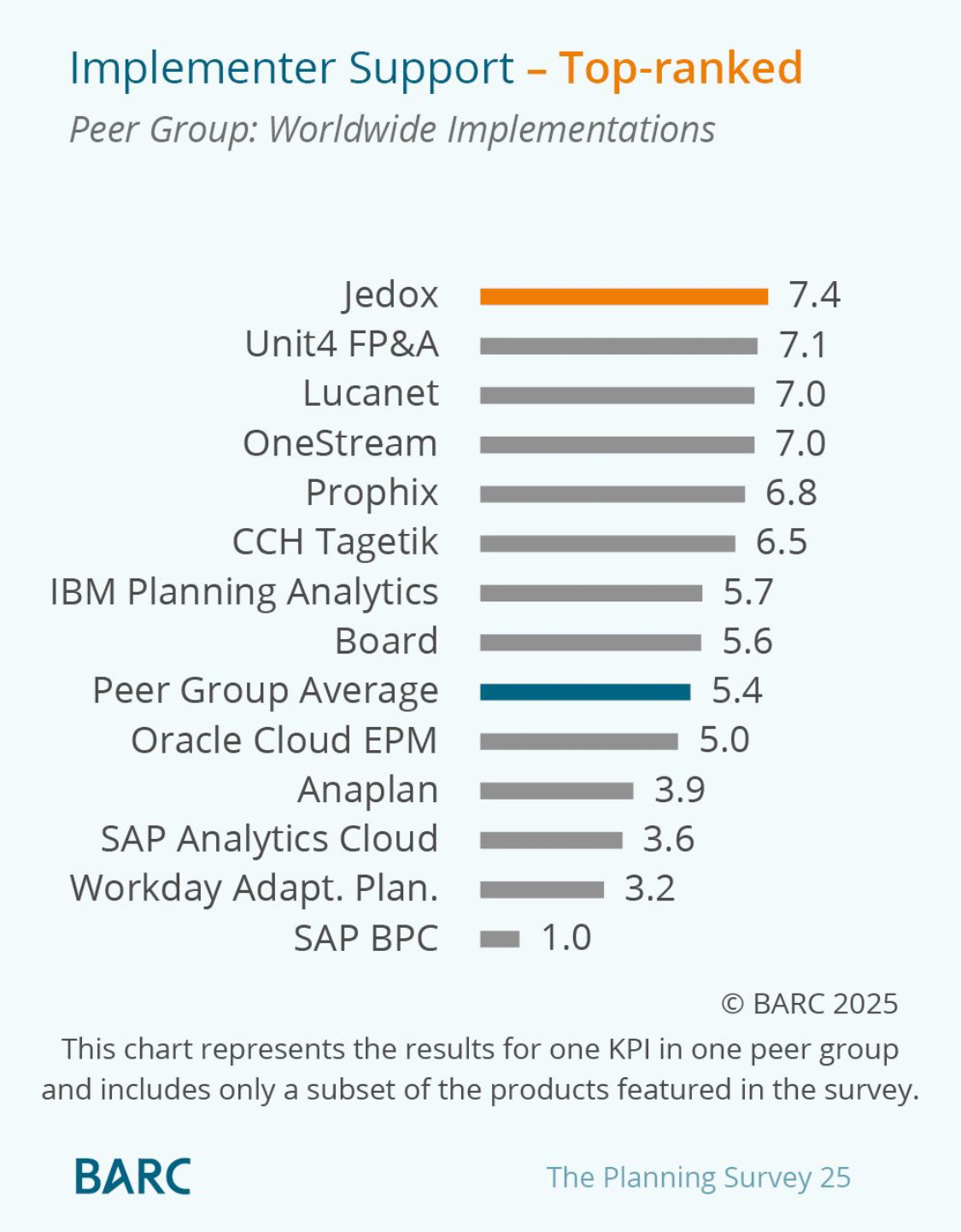

FutureView's CPM Platform is implemented using our proprietary data integrations and an advanced application leveraging Jedox and its multidimensional cube structure. Jedox is a leading software provider in the planning space, with a recent BARC Survey of finance executives indicating the company having the best implementation support—their words, not ours.

"The implementation is what makes CPM software and the team and FutureView is phenomal. They quickly developed and automated everything I used to do in Excel, only better." — Rob Johnson, CFO at IANS.

The decision between basic FP&A tools and CPM software isn't just about technology – it's about the strategic role you want finance to play in your organization. The last thing you want is to commit to a marginally better process and tool that you outgrow in less than 18 months and require a secondary procurement and system implementation.

The finance function is at a crossroads. Traditional FP&A tools offer the comfort of familiar processes with modest efficiency gains, but they fundamentally limit your organization’s potential. CPM software, implemented by proven partners with deep finance and technical expertise, represents a strategic investment in your organization’s future.

The question isn’t whether you can afford to implement CPM software – it’s whether you can afford not to. In an increasingly competitive business environment, the organizations that win will be those that empower their finance teams to be strategic partners, not just number-crunchers.

The choice is clear: enablement or empowerment. Manual processes or automated intelligence. Reactive reporting or proactive strategic insights. Empowerment is the clear choice of high performance finance functions.